stock average cost formula

Averaging into a position can drive to a much different breakeven point from the initial buy. The total inventory units are 410 nos with a beginning stock.

For cryptocurrencies the calculation is essentially the same but the terminology is different.

. Lets take my investment for example. Cost of Goods Manufactured. Here is how to calculate the average purchase price for any stock position.

The total amount invested equals 52000 and the average cost basis is calculated by dividing 52000 by 3500 shares. This simple equation allows you to find out how much inventory a company has on hand averaged across its entire inventory. Common Stock Total Equity Preferred Stock Additional Paid-in Capital Retained Earnings Treasury Stock Common Stock 1000000 300000 200000 100000 100000 Common Stock 500000.

So Id state XXX Average Cost of holding is 13350665 and for ZZZ is 2200400 being the latest date for a stock with a positive purchase qty. This is part of a video series and dives deep i. Using the three figures you have calculated above you can now complete the safety stock formula.

Last week Tony bought a cryptocurrency coin called ADA Cardano he bought 100 ADA with an average buy of 2 so the total cost is 200. Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. Total Amount Bought Shares BoughtPurchased Price 1st Shares BoughtPurchased Price 2nd Shares BoughtPurchased Price 3rd.

In WAC the cost of goods available for sale is divided by the number of products available for sale. Get stock average calculator for play store. Using the data and assuming 365 days we can calculate the avg Inventory Period as follows.

Average cost total costtotal coins acquired. Price Average Price Of New Stocks Bought 2. You can also figure out the average purchase price for each investment by dividing.

Average Total Cost 3945000 2000. Average Price Paid weighted average. Its formula is given by.

You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. Higher ratio indicates that the companys product is in high demand and sells quickly resulting in lower inventory management costs and more earnings. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

Dividing the sum of total cost by the number of the total shares. New Average Price Previous Ave. Turnover Inventory turnover or the inventory turnover ratio is the number of times a business sells and replaces its stock of goods during a given period.

Weighted Average Cost WAC Method Formula. The formula for average stock is. 7 SUMPRODUCT A2A4 B2B4 SUM B2B4.

Time to achieve Excellence in ExcelIn this video you will learn how to calculate the average price in Excel. The formula for weighted average cost WAC method. The average cost is 1486 per share.

So if you see here as we increase the number of cars the average total cost per car dropped. Shares BoughtPurchased Price nth 3. This is because that fixed cost is now spread over 2000 units and per unit fixed cost.

I think youre saying my average costs for the current holding of 50 XXX and 200 ZZZ is 133 and 2 respectively. To determine safety stock simply multiply these three numbers. You can use this information to create an average inventory target.

To determine your previous average price just look at your portfolio and look under the average price column. E Market value of the firms equity D Market value of the firms debt V E D R e Cost of equity R d Cost of debt T c. 0128 x 8 days 85 units 8704 units.

Divide the total amount invested by the total shares bought. For stocks the formula we use for the average cost calculator spreadsheet is as follows. Indian stock market average calculator.

WACC E V R e D V R d 1 T c where. Your inventory is now at 8704 units or 870 as you would round decimals to the nearest number. To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858.

To compute the average price divide the total purchase amount by the number of shares purchased to get the average price per share. Cost Basis Average cost per share 4858 x of shares sold 5 24290. What is the formula for average stock.

Average cost total costnumber of shares. How To Calculate Average Cost Review. In the screenshot above my previous average price was 49031.

Read more of 8 times. Stock Average Price Total Amount Bought Total Shares Bought. For example if the numbers are 80 95 100 77 and 90 the total is 442The difference between net proceeds of the sale and the cost basis in this example indicates a gain of 10710You will do this with the following average cost formula.

Sum the amount invested and shares bought columns. Average Total Cost 1973. 3658 4563.

The formula for the weighted average cost method is as follows. Average stock opening stock closing stock 2.

Wacc Formula Cost Of Capital Plan Projections Cost Of Capital Finance Debt Debt To Equity Ratio

Stock Average Calculator In 2021 Investing Calculator Average

How Much Stock To Bring To A Craft Show Calculations Formulas Made Urban Craft Fair Displays Craft Show Displays Craft Fairs

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Evaluating New Projects With Weighted Average Cost Of Capital Wacc Cost Of Capital Evaluation Weighted Average

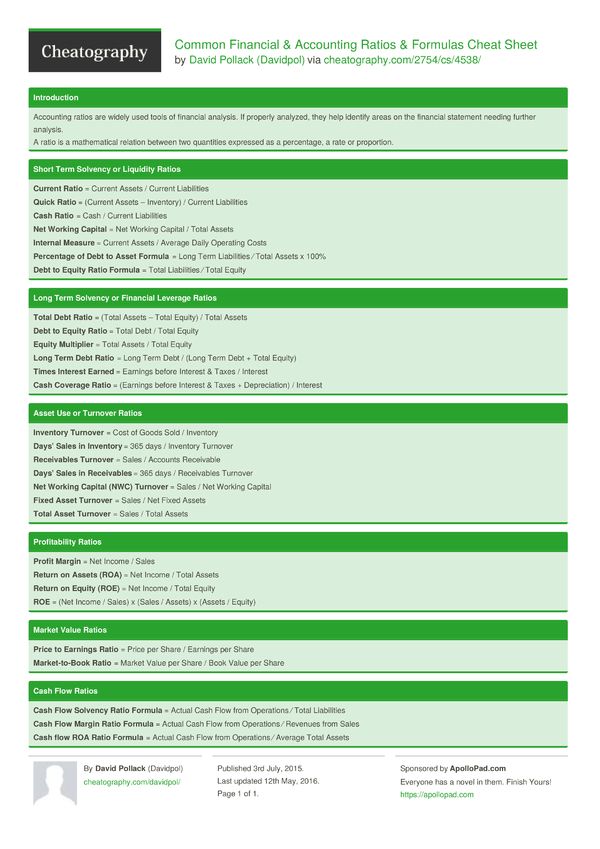

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Financial Accounting

Retail Math Formulas Cheat Sheet Math Formulas Math Cheat Sheet Math

Wacc Calculator And Step By Step Guide Discoverci Book Outline Corporate Bonds Financial Calculators

Step 1 Capital Structure Of A Company Cost Of Capital Calculator Step Guide

Opportunity Cost Meaning Importance Calculation And More In 2022 Opportunity Cost Meant To Be Accounting And Finance

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Accounting Basics Accounting

Project Or Divisional Weighted Average Cost Of Capital Wacc Cost Of Capital Financial Strategies Cost

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

Safety Stock Meaning Importance Formula And More Safety Stock Accounting And Finance Economic Order Quantity

Cost Of Capital Cost Of Capital Opportunity Cost Financial Management

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

Wacc Diagram Explaining What It Is Cost Of Capital Charts And Graphs Financial Management